【人気ダウンロード!】 in the absence of partnership deed interest on loan of a partner is allowed mcq 181450-In the absence of partnership deed interest on loan of a partner is allowed mcq

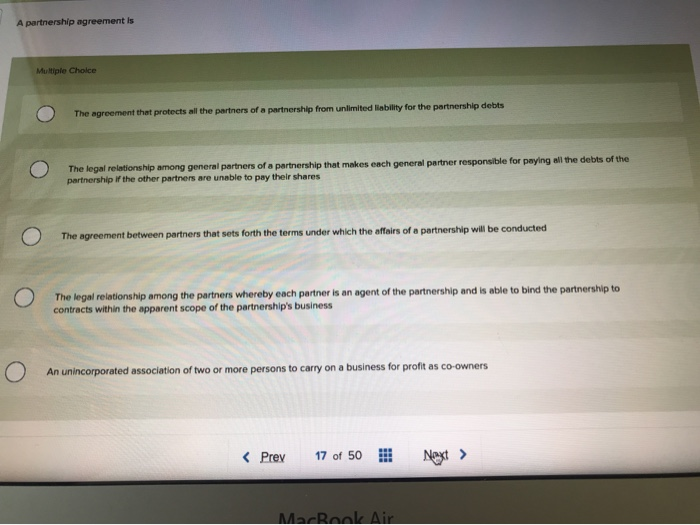

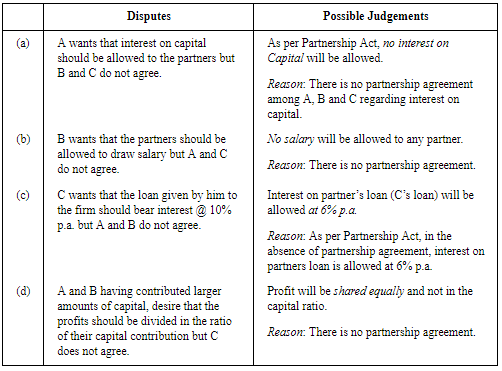

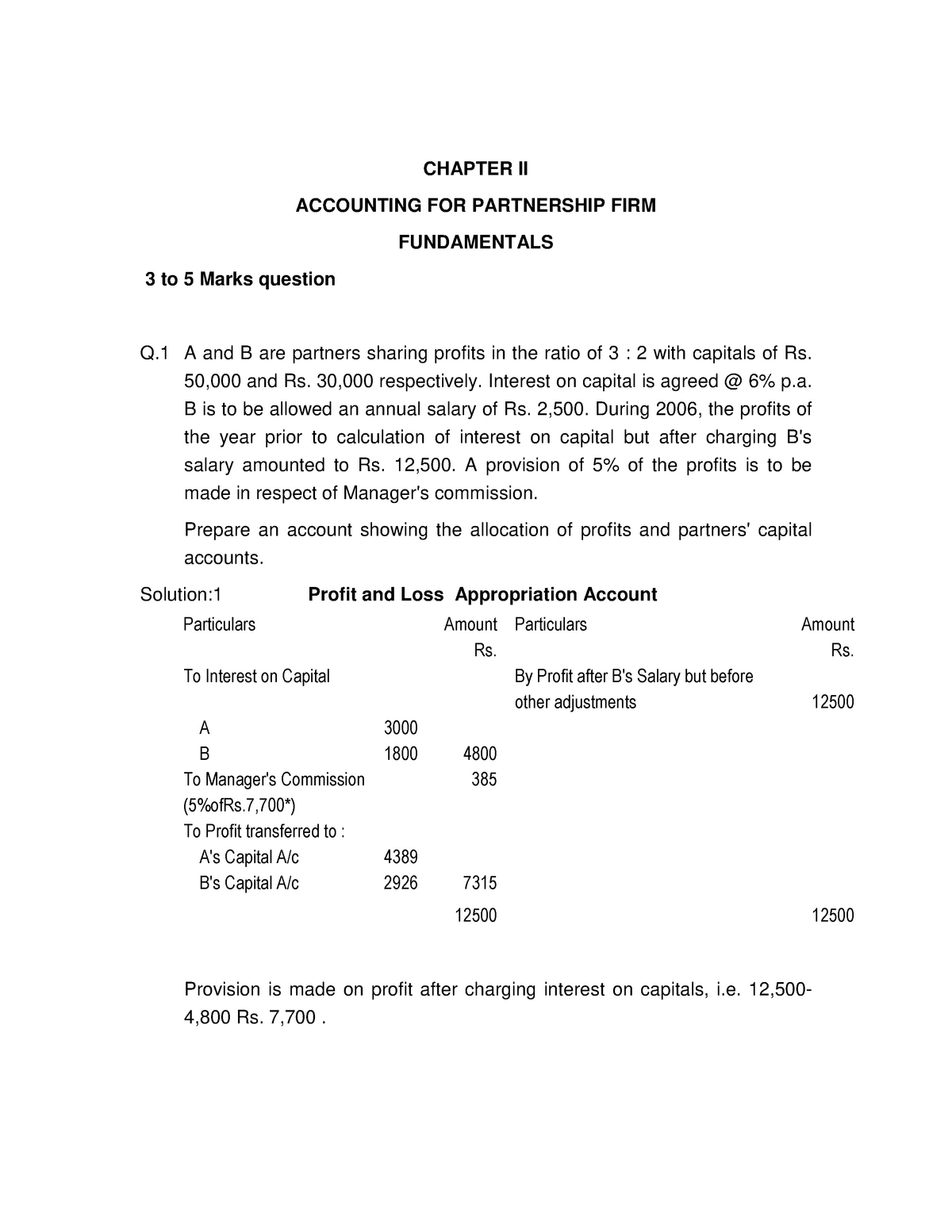

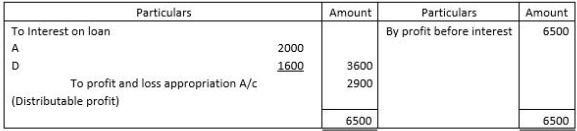

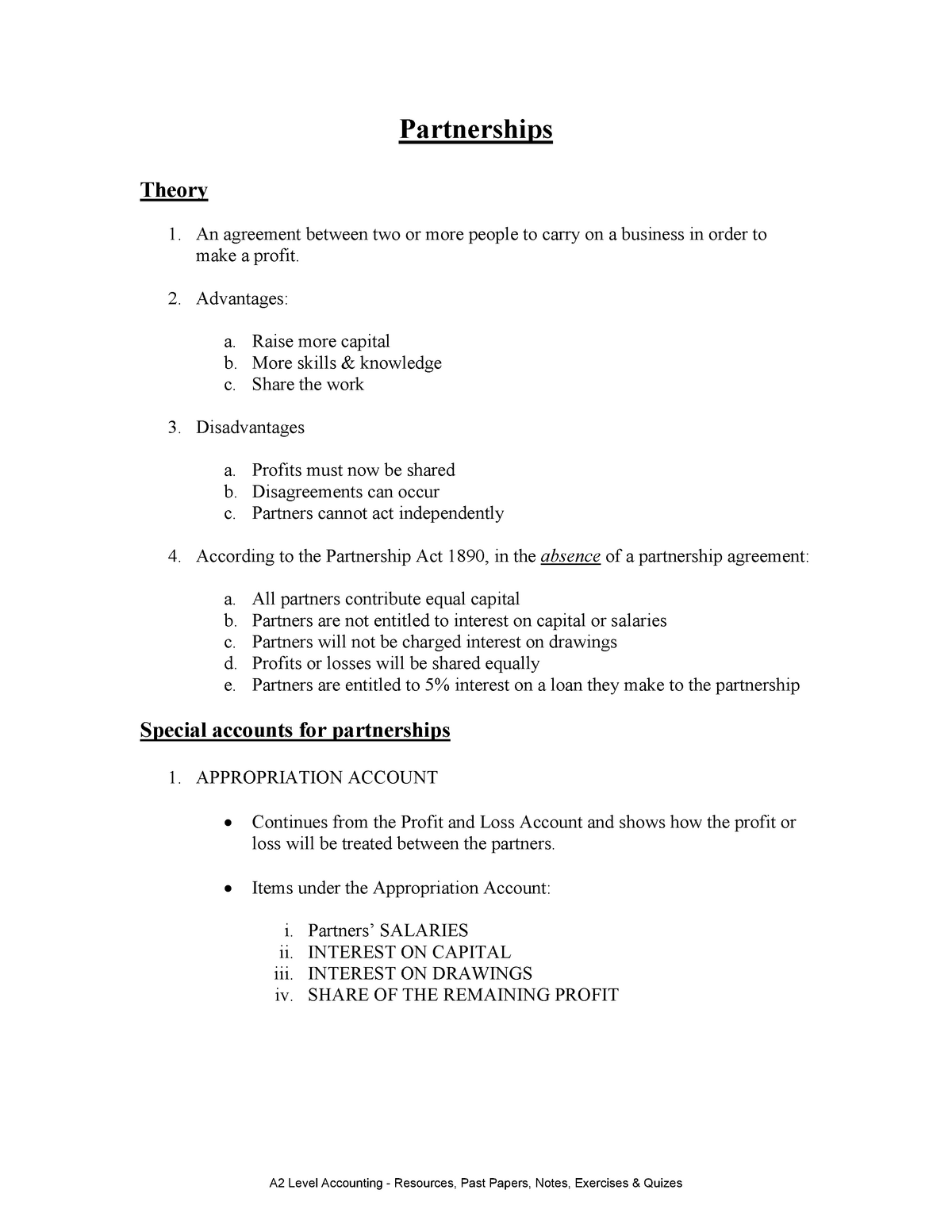

No interest will be allowed to Partners on Capital (c) Interest on loan by partner As per Indian Partnership Act, 1932, 6% pa Interest will be allowed on the loan amount of partners (d) Division of Profit In the absence of partnership deed profit is distributed equally (e) Interest on Partners' Drawings No Interest is charged from In the absence of an agreement profit and loss are divided by partners in the ratio of (a) Capital (b) Equally (T) (c) Time devoted by each partners (d) None of these (4) In the absence of an agreement, Interest on loan advanced by the partner to the firm is allowed at the rate of (a) 6% (T) (b) 5% (c) 12% (d) 9%How do you Treat in the absence of partnership Deedsharing profit, interest on drawing, capital, salary to partnerand loan from partner in explanation in

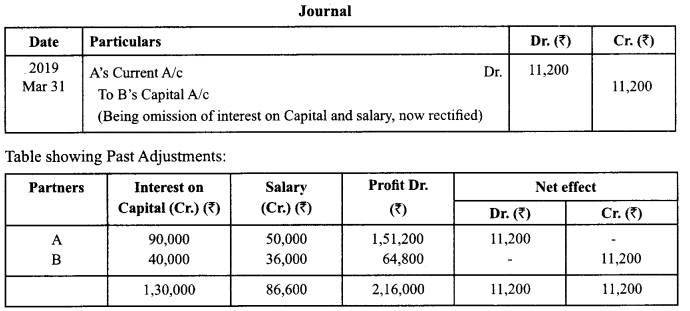

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

In the absence of partnership deed interest on loan of a partner is allowed mcq

In the absence of partnership deed interest on loan of a partner is allowed mcq-As per principle Interest on partner's loan will be allowed at 6% pa So, In this situation A and B are correct C should be allowed Interest on loan @ 6% (D) In the Absence of Partnership Deed, Profit should be distributed in Equal Ratio not in capital ratio So, in this situation C is correct A and B are wrong (A) when there is no partnership deed (B) where there is a partnership deed but there are differences of opinion between the partners when capital contribution by the partners varies (D) when the partner's salary and interest on capital are not incorporated in the partnership deed

Partnership Deeds Meaning Contents With Solved Questions

• Interest on capital ‐ Not allowed • Interest on Drawings ‐Not • Interest on Loan ‐ 6% paInterest Allowed • Distribution of Profit or loss ‐ Equal Ratio • Salary, commission to partners ‐ Not Allowed 16 State two methods of maintaining partners capital accounts in partnership firm • Fixed capital Method • Fluctuating Capital Method 17 In the absence of Partnership Deed, the interest is allowed on the loan given by the partners to the firm— (a) 9% per annum (b) 8% per annum (c) 6% per annum (d) 5% per annum 5 In the absence of Partnership Deed, the interest is allowed on the capital of the partner— (a) No interest is allowed (b) @ 9% per annum (c) @ 5% per annum (d) @ 6% per annum 6 In In the absence of Partnership Deed, the interest is allowed on partner's capital a) @ 5% pa b) @ 6% pa c) @ 12% pa d) No interest is allowed Ans – d) In the absence of a partnership deee, the allowable rate of interest on partners loan account will be a) 6% Simple Interest b) 6% pa Simple Interst c) 12% Simple Interest d) 12% Compunded Annually Ans – b)

In the absence of a partnership deed, the allowable rate of interest on a partners loan account will be A 4 % pa B 5 % pa C 6 % pa D 7 5 % pa Medium Open in App Solution Verified by Toppr Correct option is C 6 % pa It is not compulsory to have a partnership deed for a partnership firm Hence if a firm is not having any written agreement or a partnership deed or ifInterest at the rate of 6% is to be allowed on a partner's loan to the firm Solution In the absence of any agreement interest on advances by a partner is allowed at 6 percent pa and is allowed whether there is profit or no Interest on loan is a charge and In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm (a) @5% (b) @6% (c) @ 9% (d) @8% Answer Answer (b) @6% Question 22 Which one is not the feature of partnership?

Free MCQ's on Accounting for Partnership – Basic Concepts Each set of MCQ's consists of 10 Questions and you can see the results immediately after submitting the Set Free MCQ's on Accounting for Partnership – Basic Concepts Results Share and Enjoy !In the absence of Partnership Deed, the interest is allowed on partner's capital @ 5% pa @ 6% pa @ 12% pa No interest is allowed 26 In the absence of agreement, partners are not entitled to Salary Commission Equal share in profit Both (a) and (b) 27 In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be 6% Simple Interest 6%Interest on Loan by Partner's to the Firm;

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Ncert Books

Solved A Partnership Agreement Is 1 1 Multiple Choice Chegg Com

Since the business needed more funds, Tony gave a loan of ₹2,00,000 to the firm on 30th June, 18 Their partnership deed provided for (a) Interest on capital to be allowed @10% per annum (b) Interest on drawings to be charged @ 6% per annum (c) Anita to be given a commission of 4% on the corrected net profits before charging commissionIn the absence of Partnership Deed AInterest will not be charged on partner's drawings,BInterest will be charged @ 5% pa on partner's drawings,CInterest will be charged @ 6% pa on partner's drawings,DInterest will be charged @ 12% pa on partner's drawings In the absence of partnership deed, each partner gets equal share in profit, no matter how much contribution made by him including sleeping partner Answer 12 – b) Equal share in profit Explanation 13In the absence of partnership deed, interest @6% pa is to be allowed on loans and advances of partners Answer 13 – b) Interest on loan @6% a

Fundamentals Of Partnership Mcq With Answer

Mcq Questions Class 12 Accountancy Accounting For Partnership

(a) Agreement (b) Sharing of Profit (c) Limited Liability (d) Two or more than two persons Answer Answer (c) Limited Liability Question 23 In the absenceIn the absence of a partnership deed, the allowable rate of interest on a partners loan account will be A 4 % pa B 5 % pa C 6 % pa D 7 5 % pa Answer Correct option is C 6 % pa It is not compulsory to have a partnership deed for a partnership firm Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on If there is any baiance left unpaid to the retiring / deceased partner, then interest @ will be given in the absence any provision of partnership deed (a) 6 % (b) 57 % (c) 55 % (d) 65 % Answer Answer (a) 6 % II Fill in the blanks with correct word Question 17 At the time of retirement of a partner _____ ratio will be calculated Answer Answer gaining Question 18 To

The Absence Of Partnership Deed A Partner Is Entitled To Interest

Income Tax Mcqq Pg 1 To 18 16ubi513 Income Tax Multiple Choice Questions K1 Level Income Tax Studocu

1 Meaning of Partnership "Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of When a partner is given guarantee by other partners, loss on such guarantee will be borne by APartnership firm,BAll the other partners,CPartners who give the guarantee,DPartner with highest profit sharing ratio In the absence of partnership deed, the following rule will apply (A) No interest on capital (B) Profit sharing in capital ratio Profit based salary to working partner (D) 9% pa interest on drawings Ans (A) No interest on capital MCQ Questions Answers for Class 12 Accountancy 4 Partners in the agreement are not entitled to (A) Salary (B) Commissions

Mcq On Fundamentals Of Partnership Class 12 Accountancy

Fundamental Of Partnership Questions And Answers

Assertion (A) Interest on Loan to partner is charged @6% pa If partnership Deed does not provide for the charging of interest Reason (R) In the absence of Partnership Dee, provisions of the Partnership Act 1932 apply Thus Interest on Loan to Partner should be charged @6% pa Otherwise, interest is allowed at the agreed rate of interestIn the absence of Partnership Deed, interest on loan of a partner is allowed at 8% per annum at 6% per annum no interest is allowed at 12% per annum In the absence of Partnership Deed, the interest is allowed on partner's capital (CPT;

Multiple Choice Question Of Auditing Mcq Of Auditing om 3rd Year

Mcq Of Accounting For Partnership Firm Fundamentals Accountancy

Accounting rules for partnership are governed by the partnership act of In the absence of a partnership deed the partners are entitles to interest on capital at the rate of A and B are Partners A drew Rs 000 If the rate of Interest on Drawing is 5% per annum then ______ will amount of interest on drawing#1 In the absence of a partnership deed profit sharing ratio will be Profits will not be distributedUnder t he Partnership Act, 1932 the following rules will be applicable in the absence of an agreement among the partners If a partner has given a loan to the firm besides his share of capital, he will be allowed a 6% interest on such a loan (Section 13) Section 13 in The Indian Partnership Act, 1932 Mutual rights and liabilities—Subject to contract between the partners,—

Nta Ugc Net Practice Mcq S Of Goodwill Hindi Offered By Unacademy

Immc Swd 21 final Eng Xhtml 2 En Impact Assessment Part1 V4 Docx

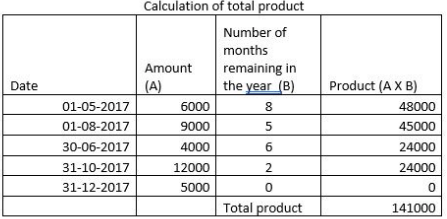

In the Absence of Partnership Deed, Interest on a Loan of a Partner is Allowed (1) at 8% per Annum (2) at 6% per Annum (3) No Interest is Allowed (4) at 12% per Annum CBSE CBSE (Arts) Class 12 Question Papers 17 Textbook Solutions Important Solutions 24 Question Bank Solutions Concept Notes & Videos 532 Time Tables 18 Syllabus Advertisement In the absence of partnership deed partner share profit and loss in (a) Ratio of capital Employed (b) Equal Ratio (c) 2 1 (d) 1 2 Answer B Question As per section a minor may be admitted for the benefit of the partnership if(a) One partner agree (b) More than one agree (c) All partners agree (d) Both (a) or (b) Answer C Question Better quality of product will Q33 On 1st January 19, a partner advanced a loan of Rs to the firm In the absence of agreement, interest on loan 31st march 19 will be a Nil b Rs 1500 c Rs 3000 d Rs 6000 Answer Rs 1500 Q34 Intangible assets (goodwill) has been defined in a AS 16 b AS c AS 26 d AS 21 Answer AS 26 Q35 Charulata is a partner

Sample Multiple Choice Questions Remedies School Of Law

2

In absence of partnership deed neither interest is paid on capital nor charged, interest on drawing The liability of each partner in partnership is limited (MP 13) In case of insolvency of a partner the deficiency of his capital is borne by all other partners Current account is opened in fluctuating capital method (MP 09 Set B) To make partnership deed is provision in the absence of partnership deed (a) salaries to partners No salary will be allowed to partners (b) Interest on partners No interest will be allowed to partners on their capital (c) Interest on partner loan 6% pa interest will be allowed on the money given by parters to the firm in the form of loans and advances (d) Distribution of profit profits will be shared If partnership deed silent, interest allowed on partner capital account will be 14 The maximum number of partner in case of nonbanking partnership firm is 15 In the absence of an agreement, interest on partner loan shall be paid @ 16 The written form of partnership agreement is call as 17

Accounting And Finance Mcqs Test 6 Finance Strategists

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

In absence of Partnership agreement interest on partner's loan/Advance will be calculated at 6% pa (5% / 6% / 8%) 14 The partner who does not participate actively in partnership business is knows as nominal (nominal / inactive) partnerInterest on Loan by the Firm to Partners ; A and B were sharing profits of a business in the ratio of 3 2 They admit C into partnership, who gets 1/3 of A's share of profit from A, 1/2 of B's share of profit from B The new profit sharing ratio will be– 8 In the absence of a Partnership Deed, the rate of interest allowed on the partner's loan to the firm is– 9

Doc Wa0001 Pdf Multiple Choice Questions For Partnership Act Mcqs 1 2 3 4 5 6 7 8 9 Each Questions Has Four Possible Answers Choose The Course Hero

Solved A Partnership Agreement Is Multiple Choice The Chegg Com

Debt Interest Interest at a rate of 6% pa It is be given the company on a partner's loan Such interest is be paid and in the case of damages the company Question 2 State four important points which must be incorporated in a Partnership Deed Solution 2 In the absence of the Partnership Deed, following are the terms of the Partnership Act 1) If both the partners Provisions Applicable in the Absence of Partnership Agreement/Partnership Deed;Share and Enjoy !

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Pdf Multiple Choice Questions Chapter 1 Introducing The Firm And Its Goal Mithlesh Prasad Academia Edu

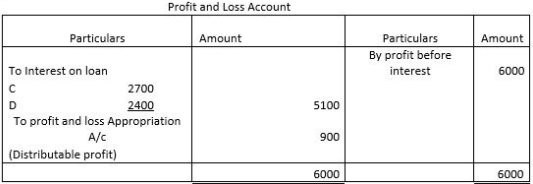

1 Interest on loan taken by a partner is recorded on_____ of Profit and Loss Account Credit side 2 Interest on Capital are under the Fixed Capital Account method is credited to _____ Partners Current A/c 3 In the absence of partnership deed rate of interest on partner loan will be_____ 6% p a 4 If drawings of equal amount areAdeebfarhan1p8g6of adeebfarhan1p8g6of Accountancy Secondary School In the absence if partnership deed, intrest on partner's loanIn the absence of Partnership Deep, partners will share the profits and losses in the equal ratio In absence of Partnership Deed, partners will get salary, commission etc The main purpose of preparing P&L Appropriation A/C of a Partnership concern is to

2

Profit Academy Photos Facebook

Rules applicable in the absence of Partnership Deed Interest on Loans –Interest @ 6% pa is to be allowed on the loan given by the partners to the firm Right to participate in the conduct of the business – Each partner has the right to participate in the conduct of the business Admission of A new partner Admission of A new partner cannot be admitted into the firmJune 11) (A) @ 5% pa (B) @ 6% pa @ 12% pa (D) No interest is allowed Answer Answer D 19 In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be (A) 6% Simple Interest (B) 6% pa Simple Interest 12% Simple InterestIn the absence of Partnership Deed, interest on Partner's loan is provided (a) 6% pa (b) 7% pa (c) 4% pa (d) 10% pa R Answer (a) 6% pa Question Explain any four factors affecting Goodwill of firm Answer (i) Efficient Management If the management of firm is efficient ie, capable and competent for managing firm's activities then, it will lead to higher profits, thus

Mcq On Fundamentals Of Partnership Class 12 Accountancy

Mcq Questions For Class 12 Accountancy Chapter 2 Free Pdf Download

Rent Paid or Payable to Partner; In the absence of Partnership Deed, the interest is allowed on partner's capital (CPT;June 11) (A) @ 5% pa (B) @ 6% pa @ 12% pa (D) No interest is allowed Answer Answer D 19 In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be (A) 6% Simple Interest (B) 6% pa Simple Interest 12% Simple Interest

2

Fundamentals Of Partnership Mcq With Answer

MCQ Questions for Class 12 Accountancy with Answers Q1 In the absence of partnership deed how much interest will be given on capital?In the absence of Partnership Deed, the interest is allowed on partner's capital (A) @ 5% pa (B) @ 6% pa @ 12% pa (D) No interest is allowed Answer D Ques In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be (A) 6% Simple Interest (B) 6% pa Simple Interest 12% SimpleIn the absence of Partnership Deed, 6% is the rate of interest on loan advanced by partner to the firm

Page 30 Debk Vol 1

Fundamentals Of Partnership Mcqs And Answer 12 Cbse Exam 22

A partnership deed is an agreement between two or more individuals who sign a contract to start a profitable business together They agree to be the coowners, distribute responsibilities, income or losses for running a business In the Partnership deed, the partners are equally responsible for the debt of an organisation The documentation of all these features of partnerships agreement is In the absence of partnership deed, interest @ 6% pa will be allowed on partner's Loan Answer Answer True Question 46 In the absence of partnership deed, interest on capital will be given @ 6% pa Answer Answer False Question 47 In case of LLP business in partnership, maximum number of partners are limited Answer Answer False Question 48 Partnership deedThe absence of partnership deed, interest on loan of a partner is allowed A at 8% pa B at 6% pa C No interest is allowed D at 12% pa

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

2

Click here 👆 to get an answer to your question ️ in the absence if partnership deed, intrest on partner's loan is? In the absence of Partnership Deed , Interest on loan of a partner is allowed a) 8% per annum 2 In the absence of Partnership Deed Interest on Drawing of a partner is charged b) 9 % per annum c) 6% per annum d) No Interest is chargedQ2 Interest on Partner's drawings will be debited to Q3 The interest on partner's drawings is debited to (iv) P & L App A/c

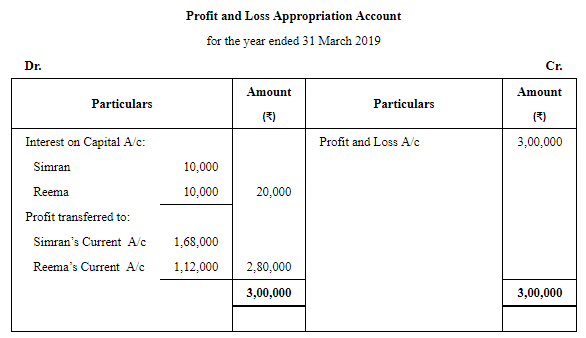

Profit And Loss Appropriation Account Accountancy Knowledge

Forming a Partnership Deed is Forming a Partnership Deed is mcq Admission of partner mcq 11 A and B are partners sharing profits and losses in the ratio of 41 C was a manager who received a salary of 2,000 per month in addition to a commission of 5% on net profits after charging such commission Profit for the year is rs 3,39,000 before

Mcq Of Accounting For Partnership Firm Fundamentals Accountancy

Accounting For Partnership Firms Fundamentals Part 4 Commerce Notes Edurev

A And B Are Partners In A Firm Sharing Profits In The Ratio Of 3 2 They Had Advanced To The Firm A Sum Of Rs 30 000 Sarthaks Econnect Largest Online Education Community

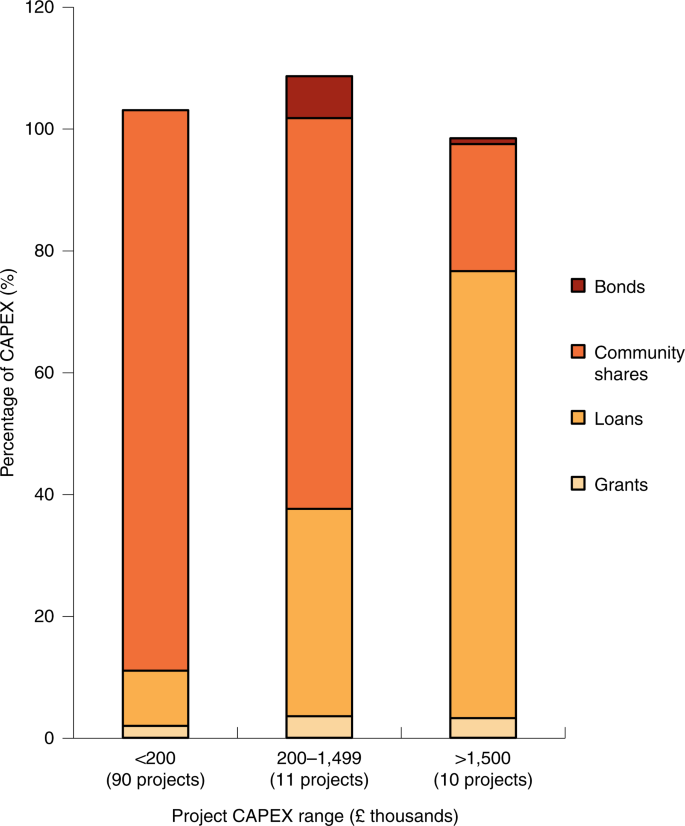

Business Models And Financial Characteristics Of Community Energy In The Uk Nature Energy

Accounting Mcq On Firm Partnership Phdtalks

Accounting And Finance Mcqs Test 6 Finance Strategists

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Mcq On Fundamentals Of Partnership Class 12 Accountancy

Partnership Deed Bhardwaj Accounting Academy

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Books

Capitalcoaching In

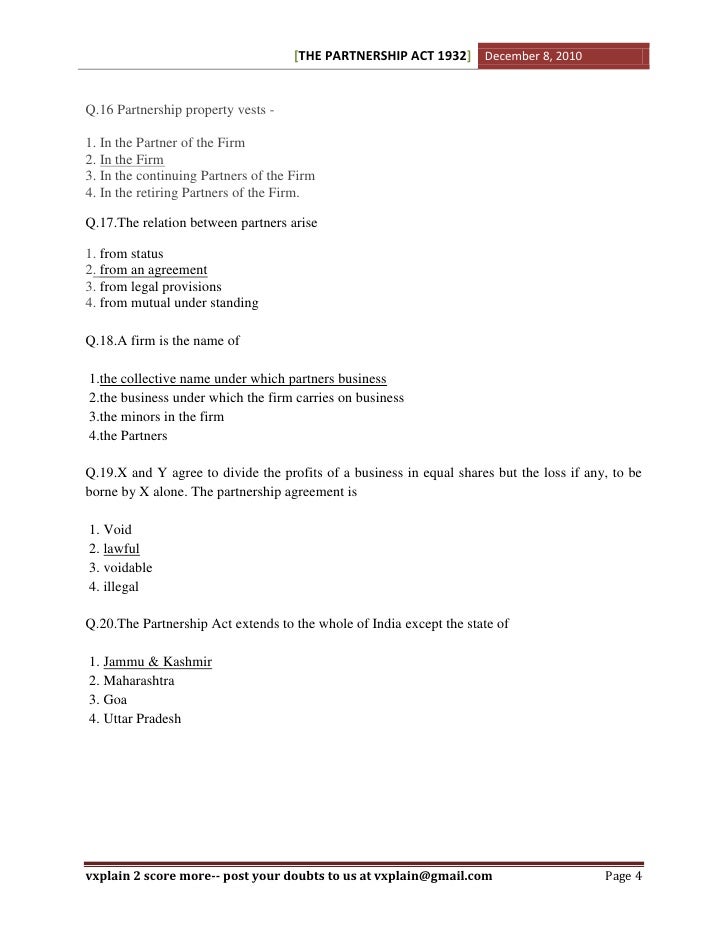

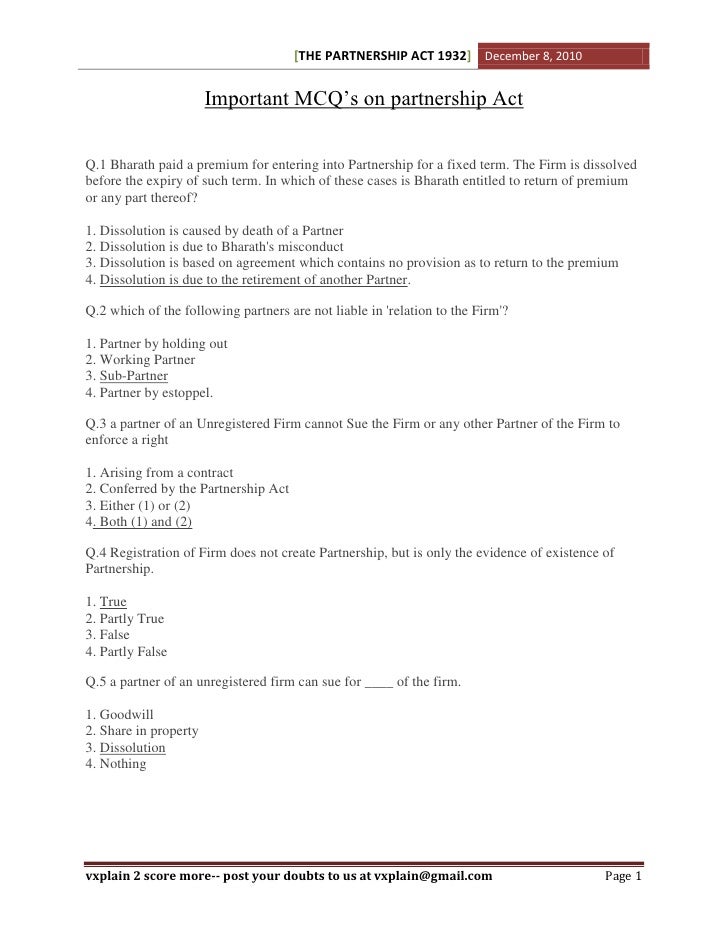

Cpt Imp Mcqs On Partnership Act

Ravi And Tiku Are Partners In A Firm According To Their Partnership Deed I Interest On Capital Will Be Allowed 5 Per Annum Sarthaks Econnect Largest Online Education Community

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Ncert Books

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 21

Partnership Deeds Meaning Contents With Solved Questions

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Accountancy Mcqs For Class 12 With Answers Chapter 1 Accounting For Partnership Firms Fundamentals Learn Cbse Pdf Partnership Debits And Credits

2

Cpt Imp Mcqs On Partnership Act

Dk Goel Solutions Class 12 Accountancy Chapter 2 Accounting For Partnership Firms Fundamentals

Profit And Loss Appropriation Account Accountancy Knowledge

2

Cbse Papers Questions Answers Mcq Cbse Class 12 Accountancy Chapter 2 Accounting For Partnership Firms Fundamentals Questions And Answers Eduvictors Cbsenotes Class12accountancy

Law Mcqs

2

Accountancy Mcqs For Class 12 With Answers Chapter 1 Accounting For Partnership Firms Fundamentals Learn Cbse

2

Mcq Questions For Class 12 Accountancy Chapter 4 Reconstitution Of Partnership Firm Retirement Death Of A Partner With Answers Ncert Solutions

Partnership Accounting Sample Questions Iba Studocu

Unit 18 The Nation And The World Economy The Economy

Mcq On Fundamentals Of Partnership Class 12 Accountancy

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

1

Mcq Of Accounts Class 12th Fundamental Of Partnership 21 22

Mcq Questions For Class 12 Accountancy Chapter 2 Accounting For Partnership Basic Concepts With Answers Ncert Solutions

Accountancy Mcqs For Class 12 With Answers Chapter 2 Change In Profit Sharing Ratio Among The Existing Partners With Answer Mod Education

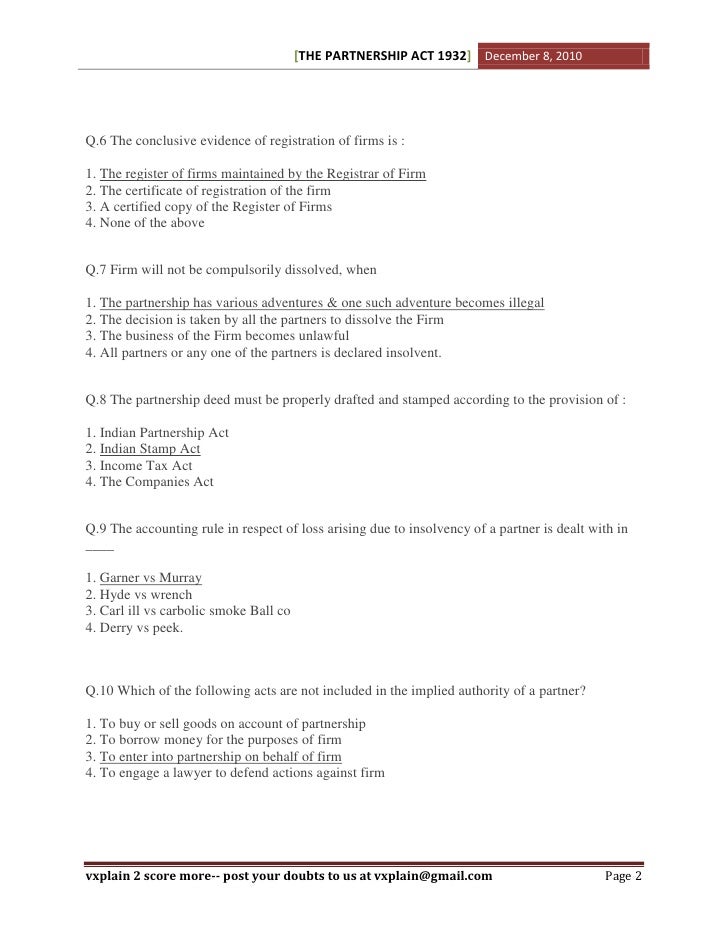

Partnership Act 1932 Mcq Multiple Choice Question Answer Mobile View Legaldawn Pdf Limited Liability Partnership Law

Mcq Class 12 Accountancy Chapter 2 Answers Accounting For Partnersh

Class 12 Accountancy Mcq Gk Quiz Exam Questions Answers

Unit 14 Unemployment And Fiscal Policy The Economy

Partnership Deed Meaning Format Registration Stamp Duty

Mcq On Basics Of Partnership Multiple Choice Questions And Answers Partnership Accounts Mcqs Cma Mcq

Unit 14 Unemployment And Fiscal Policy The Economy

Solved A Partnership Agreement Is 1 1 Multiple Choice Chegg Com

Partnership Notes Partnerships Theory An Agreement Between Two Or More People To Carry On A Studocu

Accounting For Partnership Basic Concepts Class 12 Important Questions Accountancy Chapter 2

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

Mcq Questions For Class 12 Accountancy Chapter 4 Reconstitution Of Partnership Firm Retirement Death Of A Partner With Answers Ncert Solutions

Mcqs On Partnership Accounts Mcqs On Accounting For Partnership Firms Fundamentals Youtube

2

Profit And Loss Appropriation Account Problems And Solutions

Multiple Choice Question Bank Syllabus 12

Fundamentals Of Partnership Mcqs And Answer 12 Cbse Exam 22

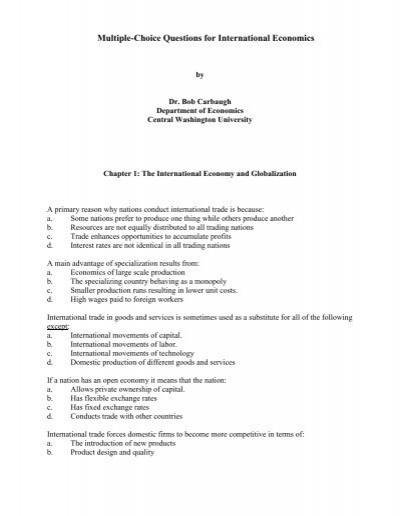

Multiple Choice Questions For International Economics Central

In The Absence Of A Partnership Agreement The Law Says That Income And Loss Course Hero

Partnership Fundamentals Objective Type Mission Accountancy

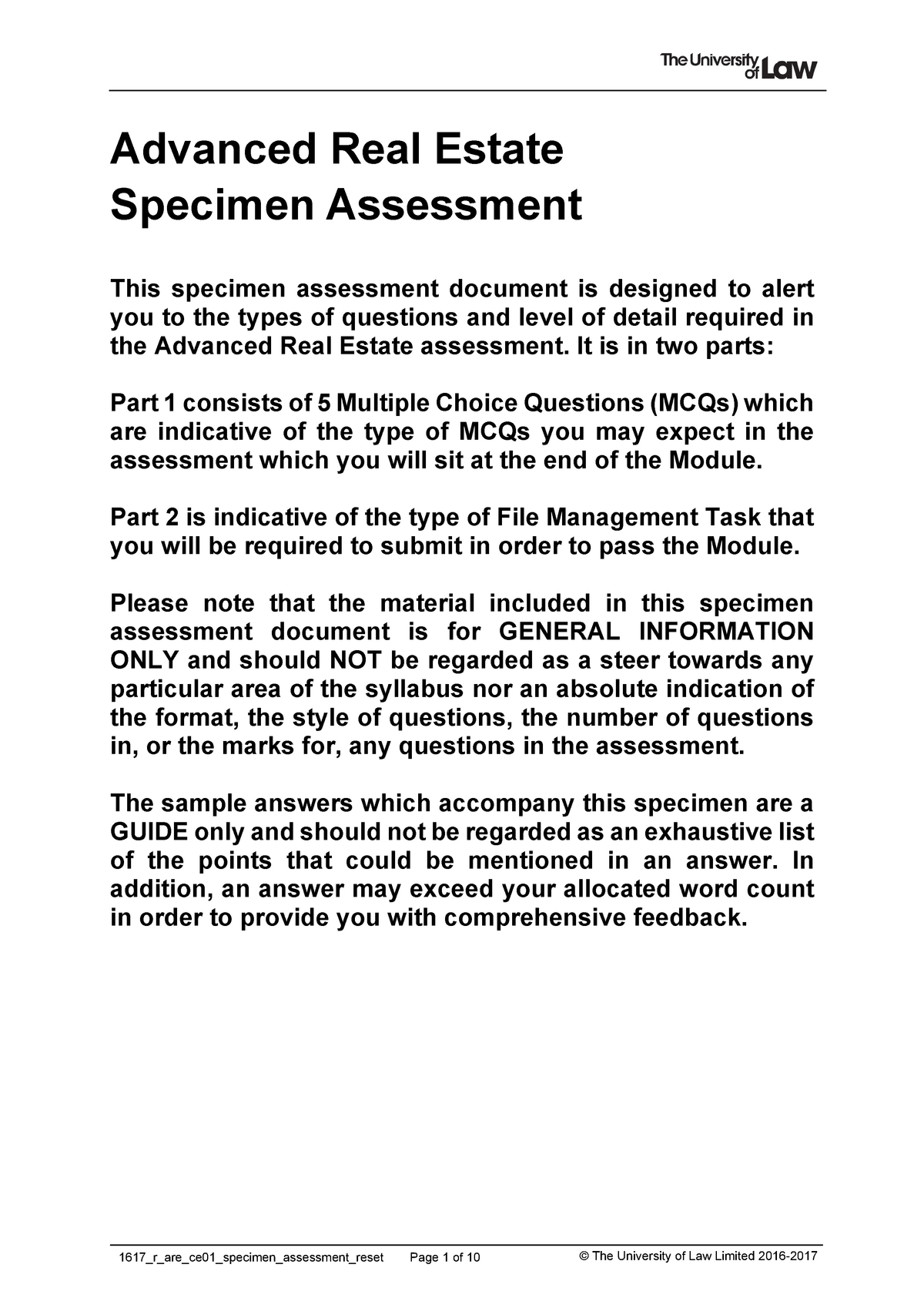

1617 R Are Ce01 Specimen Assessment Reset Advance Real Estate Law Studocu

Profit And Loss Appropriation Account Problems And Solutions

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Accountancy

Cpt Imp Mcqs On Partnership Act

Partnership Accounting Multiple Choice Questions And Answers Pdf Jobsjaano Com

Pdf Partnership Pdf Hana Suijuris Academia Edu

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Partnership Act 1932 Mcq Multiple Choice Question Answer Mobile View Legaldawn Pdf Pdf Multiple Choice Question Mcq U19s 1 Can A Company Course Hero

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Ncert Books

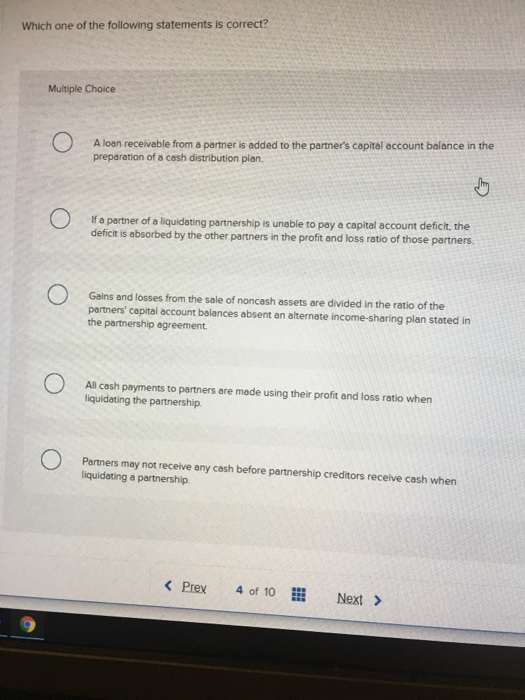

Which One Of The Following Statements Is Correct Chegg Com

Partnership Accounts

コメント

コメントを投稿